vermont sales tax food

The Vermont Statutes Online. Depending on local municipalities the total tax rate can be as high as 7.

Publications Department Of Taxes

The Brandon Vermont sales tax is 700 consisting of 600 Vermont state sales tax and 100 Brandon local sales taxesThe local sales tax consists of a 100 city sales tax.

. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0156 for a total of 6156 when. This page describes the taxability of. Since sales tax rates may change we advise you to check.

An example of items that are exempt from Vermont sales. Vermonts food and beverage sales tax exemption does not extend to soft drinks or sweetened beverages. Get Norwich Online Food Store License.

Other local-level tax rates in the. Vermont has a higher state sales tax than 654 of states. Effective July 1 2015 soft drinks are subject to Vermont tax under 32.

Taxation and Finance Chapter 233. While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. SALES AND USE TAX Subchapter 002.

Restaurant meals may also have a. The state sales tax rate in Vermont is 6000. Beginning July 1 2018 sales of advanced wood boilers are exempt from Vermont Sales and Use Tax.

Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. This page discusses various sales tax exemptions in Vermont. 974113 with the exception.

The Vermont VT state sales tax rate is currently 6. 32 VSA 974152. Vermont has a statewide sales tax rate of 6 which has been in place since 1969.

9741 13 with the exception of soft drinks. Food Food Products and Beverages Exempt Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. The Williston Vermont sales tax is 700 consisting of 600 Vermont state sales tax and 100 Williston local sales taxesThe local sales tax consists of a 100 city sales tax.

Prepared Food is subject to special sales tax rates under Vermont law. FOOD FOOD PRODUCTS AND BEVERAGES - TAXABLE. Buyers and sellers of wood boilers.

Vermont Sales Tax ID. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on. Vermonts state-wide sales tax rate is 6 at the time of this articles writing with local option taxes potentially adding on to that.

While the Vermont sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Vermont has recent rate changes Fri Jan 01 2021. The maximum local tax rate allowed by Vermont law is 1.

Its free to download and print so get your. In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Vermont sales tax details.

Date Published 2011-07-16 163818Z. This page describes the taxability of. Weve put together an Vermont Sales Tax Quick Reference Guide that puts the important information you need to know at your fingertips.

9741 9741. Soft drinks however do not include milk or milkmilk substitute. Information is valid as of.

The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax. In most states necessities such as groceries clothes and drugs are exempted. With local taxes the total sales tax rate is between 6000 and 7000.

While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Vermonts food and beverage sales tax exemption does not extend to soft drinks or sweetened beverages. The Colchester Vermont sales tax is 700 consisting of 600 Vermont state sales tax and 100 Colchester local sales taxesThe local sales tax consists of a 100 city sales tax.

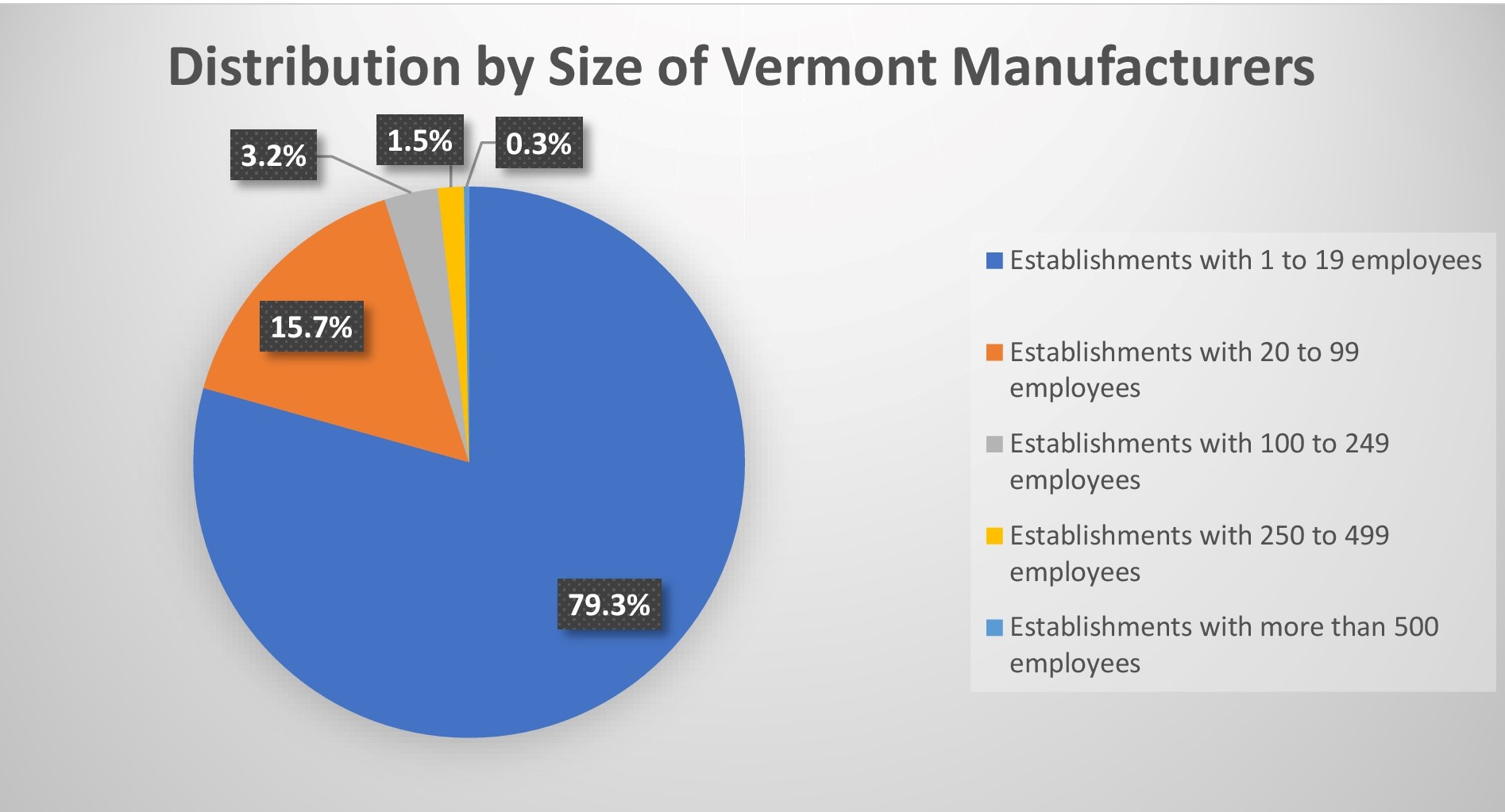

Vermont Manufacturing Facts Vmec

Vt Dept Of Taxes Vtdepttaxes Twitter

Vt Dept Of Taxes Vtdepttaxes Twitter

Angelina Crispy Crepes Angelina Paris Dark Chocolate Angelina

Vermont Castings Aspen Wood Stove Aspen Wood Wood Stove Wood

The Stamford Ct Dining Scene Is Flourishing Like Never Before With New Restaurants Opening All The Italian Recipes Best Italian Restaurants Italian Restaurant

Exemptions From The Vermont Sales Tax

Mighty Tasty Granola Organic Granola Granola Wild Rose Detox Recipes

Vacation Rental Software For Property Managers Innkeepers Bnbs And Owners Ownerrez Property Management Vacation Custom Email Template

Vermont Bun Baker Cookstove Baker S Oven Tiny Wood Stove Wood Stove Wood Stove Cooking

Vermont Sales Tax Information Sales Tax Rates And Deadlines

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Homeschooling A La Mexicana Homeschooling 529 Plan Homeschooling Articles In Magazines Homeschooling W Homeschool Encouragement Home Schooling Homeschool

Vermont Sales Tax Small Business Guide Truic

Is Clothing Taxable In Vermont Taxjar

Vermont Maple Syrup In A Maple Leaf Glass Bottles Wedding Favors Fall Soap Wedding Favors Maple Syrup Bottles

Favorite Maine Recipes Poster Excuse The Comic Sans Font I Ve Got Maine On The Mind Maine Food Recipes